Brownian Motion in Financial Markets

If asset prices in the short term show an identifiable pattern, won’t speculators will find this pattern and exploit it, thereby…

If asset prices in the short term show an identifiable pattern, won’t speculators find this pattern and exploit it, thereby eliminating it?

Brownian motion or pedesis is the term used in physics to describe the random motion of particles (such as specs of dust) suspended in a fluid(such as a liquid or gas) resulting from collisions of such particles with the fast-moving molecules of the fluid. Under a microscope, such Brownian motion could appear somewhat like the following animation where the black dots are molecules and the yellow dot represents a spec of dust:

Although theorized as early as in 1827, it wouldn’t be until the publication of one of Einstein’s 1905 Annus Mirabilis papers that Brownian motion would see its rise to prominence as a useful theory for predicting naturally-occurring random phenomena. Five years before Einstein’s publication however, a French graduate student named Louis Bachelier had proposed a similar model as useful for predicting price changes in financial markets. The model now forms the basis of many if not most quantitative models of financial markets, including the now well-known Black-Scholes model.

The purpose of this article is to explain the history and mathematical foundations of Brownian motion, as well as its underlying assumptions and implications in the context of financial markets. Happy reading!

Brownian Motion

What in modern nomenclature is now known as Brownian motion, sometimes “the Bachelier-Wiener process” was remarkably first described by the Roman philosopher Lucretius in his scientific poem De rerum natura (“On the Nature of Things”, c. 60 BC). There, he describes the motion of dust particles, and uses this description to make a somewhat shockingly concise early argument for the existence of atoms:

"Observe what happens when sunbeams are admitted into a building and shed light on its shadowy places. You will see a multitude of tiny particles mingling in a multitude of ways... their dancing is an actual indication of underlying movements of matter that are hidden from our sight. It originates with the atoms which move of themselves, then those small compound bodies that are least removed from the impetus of the atoms are set in motion by the impact of their invisible blows and in turn cannon against slightly larger bodies. So the movement mounts up from the atoms and gradually emerges to the level of our senses so that those bodies are in motion that we see in sunbeams, moved by blows that remain invisible."Excerpt, "On the Nature of Things" (Lucretius, c. 60 BC)

It would not be until 1827 however before the process’ namesake, botanist Robert Brown used a rudimentary microscope to study pollen grains floating in water that he discovered that particles ejected by the pollen grains actually do execute a “jittery” erratical motion on a microscopic scale. The motion is caused by water molecules randomly buffeting the particle of pollen. Brown posed the problem of mathematically describing his observed phenomena, but never actually did so himself. The first person to tackle the problem formally was Thorvald N. Thiele in 1880, using the method of least squares. Famously, in thermodynamics, Albert Einstein also described the phenomenon in one of his Annus Mirabilis papers of 1905, where he defined how

“According to the molecular kinetic theory of heat, bodies of a microscopically visible size suspended in liquids must, as a result of thermal molecular motions, perform motions of such magnitudes that they can be easily observed with a microscope.”

Einstein’s paper is entitled Über die von der molekularkinetischen Theorie der Wärme geforderte Bewegung von in ruhenden Flüssigkeiten suspendierten Teilchen (“On the Motion of Small Particles Suspended in a Stationary Liquid, as Required by the Molecular Kinetic Theory of Heat”) and was published on July 18th 1905 in Annalen der Physik. Although generally considered a useful concept, prior to Einstein’s paper the question of whether atoms were a real phenomenon very much remained open and unanswered. Einstein helped settle the issue, as his paper established a method for experimental physicists to count atoms with an ordinary microscope. His paper even provided a procedure for estimating Avogadro’s number (the number of atoms contained in one mole) and in a sense “put Brownian motion on the map”.

Brownian Motion in Finance

Five years before Einstein’s miracle year paper, a young French mathematician named Louis Bachelier described a process very similar to that eventually described by Einstein, albeit in the context of asset prices in financial markets.

Louis Bachelier (1900)

Louis Jean-Baptiste Alphonse Bachelier (1870–1946) was a French mathematician born in the Normandy town of Le Havre to a father who was a wine merchant turned vice-consul of Venezuela and a mother who wrote poetry books. In 1900 Bachelier submitted a doctoral thesis entitled Théorie de la spéculation, where he applied nascent descriptions of Brownian motion to describe stock and option market price fluctuations, having conducted graduate research under the supervision of Henri Poincaré at the Université de Paris.

Bachelier defended his thesis on the 29th of March 1900. It was not universally well received. The modern consensus is that the committee disagreed partly with its application of mathematical methods to areas yet unfamiliar to mathematicians, namely finance. His advisor Poincaré is recorded as having stated that Bachelier’s approach of deriving Gauss’ “law of errors” should be considered

“..very original, and all the more interesting in that Fourier’s reasoning can be extended with a few changes to the theory of errors. […] It is regrettable that Mr. Bachelier did not develop this part of his thesis further.” — Henri Poincaré

The key insight of Bachelier’s thesis was the conjecture that if asset prices in the short term show an identifiable pattern, speculators will find this pattern and exploit it, thereby eliminating it. He argued, essentially, that as as soon as the price of a stock or option begins behaving according to a predictable pattern, that pattern will disappear as a function of an efficinent (competitive) market. The notes from Bachelier’s thesis defence committee, co-signed by Poincaré, describe the idea in the following way:

One could imagine combinations of prices on which one could bet with certainty. The author cites some examples. It is clear that such combinations are never produced, or that if they are produced they will not persist. The buyer believes in a probable rise, without which he would not buy, but if he buys, there is someone who sells to him and this seller believes a fall to be probable. From this it follows that the market taken as a whole considers the mathematical expectation of all transactions and all combinations of transactions to be null.

Although somewhat scrutinized, Bachelier’s thesis was nonetheless approved and later published by Gauthier-Villars in a book of the same name, Théorie de la spéculation (1900b).

Paul A. Samuelson (1965)

After having been essentially forgotten for over fifty years, it was American mathematician Leonard Jimmie Savage (1917–1971) who discovered Bachelier’s book and around 1956 brought it to the attention of economist Paul Samuelsonat the Massachusetts Institute of Technology.

“Rotting away in the library of the University of Paris”, Samuelson later described (Nova, 2000):

“When I opened it up, it was as if a whole new world was laid out before me. In fact, as I was reading it I arranged to get a translation in English because I really wanted every precious pearl to be understood”

Samuelson’s colleague at MIT Paul Cootner did the translation (Samuelson, 2002) and Samuelson used it to further develop Bachelier’s ideas to in 1965 publish two now momentous papers in finance: Proof That Properly Anticipated Prices Fluctuate Randomly (Samuelson, 1965a) and Rational Theory of Warrant Pricing (Samuelson, 1965b) in Industrial Management Review. There, he proposed a model of option pricing closely related to the key thesis in Bachelier’s work, citing his influence.

In Proof That Properly Anticipated Prices Fluctuate Randomly (1965a) Samuelson provides the mathematical foundation for what has later become known as theefficient-market hypothesis (Fema, 1965), the conjecture that asset prices fully reflect all available information in the market. As indicated in its title, the main contribution of the paper was the establishment of the mathematical grounding for the claim that in well-informed and competitive markets, price changes will essentially be random (Merton, 2006).

The claim rests on the fact that the changes in the price of common stocks, bonds and commodity futures rely on economic variables such as GNP, inflation, unemployment, earnings, and even the weather, all of which exhibit cyclic or serial dependencies. Starting from the observation that in a competitive market, if everyone knew that speculation was going to drive the price of a security up by less or more than its expected rate of return, the price of the security would already have been bid up/down to negate that possibility. Thus, in “informed” markets, current speculative prices will always reflect anticipated or forecastable changes in the underlying economic variables, thus only leaving unanticipated or unforecastable changes open to speculation, changes which must be assumed to behave randomly. Samuelson’s proof by induction hence showed that changes in speculative prices around a price reflecting the expected rate of return will form a so-called martingale (sequence of random variables whose expected future value is equal to the present value).

Black and Scholes (1973)

In the late 1960s, based on the works of Bachelier (via Samuelson), Sheen Kassouf, Ed Thorpamong and others, economists Fischer Black and Myron Scholes demonstrated that the dynamic revision of a portfolio removes the expected return of the security, inventing what was to be known as the ‘risk neutral argument’. Their model, published and named in their honor for making it public, the Black-Scholes model, simulates the dynamics of financial markets containing derivative instruments. The equation governing the price of an option over time in the model is given in rewritten form below to demonstrate the risk neutral argument:

In this form of the Black-Scholes equation, the left side represents the change in the value/price of a stock option V due to time t increasing + the convexity of the option’s value relative to the price of the stock. The right hand side representsthe risk-free return from a long position in the option and a short position consisting of ∂V/∂S shares of the stock. In terms of the greeks:

Black and Scholes’ key observation was that the risk-free return of the combined portfolio of stocks and options on the right hand side of the equation above, over any infinitesimal time interval could be expressed as the sum of theta (Θ) and a term incorporating gamma (Γ). It is called the risk neutral argument because the value of theta (Θ) is typically negative (because the value of the option decreases as time moves closer to expiration) and the value of gamma (Γ) is typically positive (reflecting the gains the portfolio receives from holding the option). In sum, the losses from theta and the gains from gamma offset one another, resulting in returns at a risk-free rate.

Robert C. Merton later extended the mathematical understanding of the Black-Scholes model, and was also the person to coin the model as the “Black-Scholes options pricing model” (which now sometimes also goes by the name the Black-Scholes-Merton model”). Since its introduction in 1973 and refinement in the 1970s and 80s, the model has become the de-facto standard for estimating the price of European-style stock options.

The mathematics of Brownian motion

Brownian motion is a stochastic process, that is, it consists of a collection of random variables, and its basic properties are:

- Brownian motion is a Gaussian process, i.e. the movement vectors the process generates are normally distributed;

- Brownian motion has stationary increments, i.e. its probability distribution does not change over time;

- Brownian motion is a martingale, i.e. its movement vectors produce a sequence of random variables whose conditional expectation of the next value in the sequence, given all prior values, is equal to the present value;

Among its more curious properties, despite it being a continuous process everywhere, it is not differentiable anywhere (Ermogenous, 2005). It is also fractal, i.e. it is self-similar at micro- and macroscopic scales, and will, if run long enough, hit any and every value no matter how large or how negative infinitely many times.

Wiener process

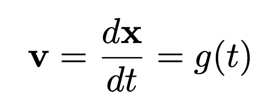

In mathematics, Brownian motion is modeled according to (and often referred to) as the Wiener process after its namesake Norbert Wiener who described the dynamics of its motion mathematically with his introduction of the Wiener equation:

The equation provides an estimate for the current velocity of a fluid particle which fluctuates randomly. The equation is suitable for finding estimates of velocity over longer time scales (as opposed to the Langevin equation which deals with rapidly changing velocities/acceleration). More generally, the Wiener process is the perhaps most well-known case of a broader family of stochastic processes called Lévy processes characterized by independent stationary increments.

Random walks

Another way of looking at Brownian motion/Wiener processes, is as the integral of a white noise signal:

Karl Pearson in 1905 first described a stochastic process related to the Wiener process/Brownian motion, which he then referred to as the ‘random walk’. The phrase was in finance popularized by the publication of Burton Malkiel’s classic 1973 book A Random Walk Down Wall Street. A random walk is best described as a stochastic, mathematical object that describes a path that consists of a succession of random steps on some mathematical space such as the integers. Random walks are a fundamental topic in discussions of so-called Markov processes, as a one-dimensional random walk can also be viewed as a Markov chain whose state space is given by the integers.

Implications for Financial Modelling

Introduced first in Bachelier’s thesis, then proved by induction to be unavoidable by Samuelson (given certain assumptions and limitations) the claim that price changes in financial securities evolve at random has since been widely adopted and put into practice in financial economics.

The same year that saw the publication of Samuelson’s two groundbreaking papers, also saw the introduction of the following formulation of the natural conclusion of his and Bachelier’s work, by Fama (1965):

In an efficient market, competition among the many intelligent participants leads to a situation where, at any point in time, actual prices of individual securities already reflect the effects of information based both on events that have already occurred and on events which, as of now, the market expects to take place in he future. In other words, in an efficient market at any point in time the actual price of a security will be a good estimate of its intrinsic value.

Since its introduction and later extensions, the theory now known as the “efficient-market hypothesis” (EMH) is often simply stated as “asset prices fully reflect all available information”, and one of its implications that “it is impossible to beat the market consistently on a risk-adjusted basis since market prices should only react to new information”.

In a later discussion on the efficient market hypothesis, Samuelson himself describes being keenly aware of the “ever-present danger of banalization” by those who fail to appreciate the subtle character of the theory (Merton, 2006), concluding in a chapter in the 1972 book Mathematical Topics in Economic Theory and Computation that:

“The theorem is so general that I must confess to having oscillated over the years in my own mind between regarding it as trivially obvious and regarding it as remarkably sweeping. Such perhaps is characteristic of basic results.

Criticisms

Critics of the usefulness of Brownian motion in modeling price changes in securities will typically argue that three its core assumptions, of 1. Independence of price movements, 2. The statistical stationarity of price changes and 3. Normally distributed price movements renders the concept not suitable for application in real-world markets. Essentially, these criticisms typically come down to (Borna & Sharma, 2011):

- Assumption of independence of price movements — The first assumption, core both to the concept of Brownian motion and every financial model based on it, is that each price movement is independent from the last, i.e. there is no predictable pattern to discern from price movements, as they all involve unanticipated and/or unforecastable changes which must be assumed to behave randomly. Critics of the assumption point out that empirical studies investigating so-called short-term dependence have shown that stock prices do not behave randomly, rather if they begin rising, the odds are slightly in favor of it continuing to rise in the short-term. In the mid to long term (3–8 years), findings suggest that the opposite is true, stocks that rose over one multi-year period are at slightly greater odds of falling in the next.

- Assumption of stationarity — The second assumption, that so-called dissonant price changes (large fluctuations are to be ignored) can be ignored, also comes under scrutiny from critics, who point to analyses of e.g. commodity prices (Mandelbrot, 1963) which question the validity of the claim. Relevant other analyses highlighted by critics include those of stock prices (Fama, 1965) and currencies (Citigroup, 2002).

- Assumption of normal distribution — Finally, the assumption of normally distributed stock prices is also criticized. Often, the cited studies include those of price fluctuations such as that by Fama (1970), which found that large price changes (of more than five standard deviations from the mean) happened 2,000 time more often than expected by models assuming normal distribution.

Yet still, Brownian motion remains widely applied to quantitative models of financial markets and market speculation (Grossman, 1992; Borna & Sharma, 2011).